Desplácese hacia abajo para leer esto en español.

Is a $500 Trust the Right Investment for Your Future?

I was recently invited by a local church to speak on estate planning. The church asked if I could return and meet with some of the members of the church for consultations. Of course, I was happy to do it.

I met with at least 10 families at the church. Three of those clients already had trust that they wanted me to review their trust. All 3 trusts had serious issues. One trust had paragraphs that were missing in ways that the trust made no sense. Another left the assets to the woman’s ex-husband and she had no idea. And the third was a married couple’s trust that was only 7 pages.

I am not kidding – it was a total of 7 pages with the notary page.

In 6 or 7 pages, you can’t properly cover what happens if the client is incapacitated or include Medi-Cal qualification strategies, you can’t cover how retirement accounts are going to be treated, ways to avoid a lengthy court process if none of the named trustees can serve, or what happens if a beneficiary becomes disabled after the trust is signed and the assets need to be distributed as a Special Needs Trust to qualify for benefits. That’s why our trusts are 70 pages and not 7.

After meeting with these 3 clients at the church – the 4th client came in and the first thing she stated was that she did not want to pay more than $500 for her trust. I was able to share with her what a $500 trust gets you.

I explained that choosing an attorney or drafting service who offers a trust that costs only $500 should be an immediate red flag because it will, 100% of the time, lack the depth and personalization required for comprehensive and tailored estate planning.

Not to mention that a firm or a drafting service that offers low cost planning must do a lot of plans or help a lot of clients so that the business makes financial sense – so you very likely won’t get a call back when you have a question years later or your children may not get a call back when you become incapacitated or pass away and need guidance and help.

A quick story: A client recently called me after her father passed. He owned 3 properties and had a Legal Zoom trust. The client shared with me that while her father was dying – literally 24 hours before he passed away – he asked her to call an attorney. He told his daughter that while he had a trust – he knew it was not done correctly. I find it so sad that just before his passing – this is what he was worried about!

This is such a contrast with our clients feel – our clients find peace of mind knowing their families are protected, and their wishes will be honored. That’s the difference with The Wagon Legacy—we don’t just create trusts; we build lasting relationships and provide genuine security for the future.

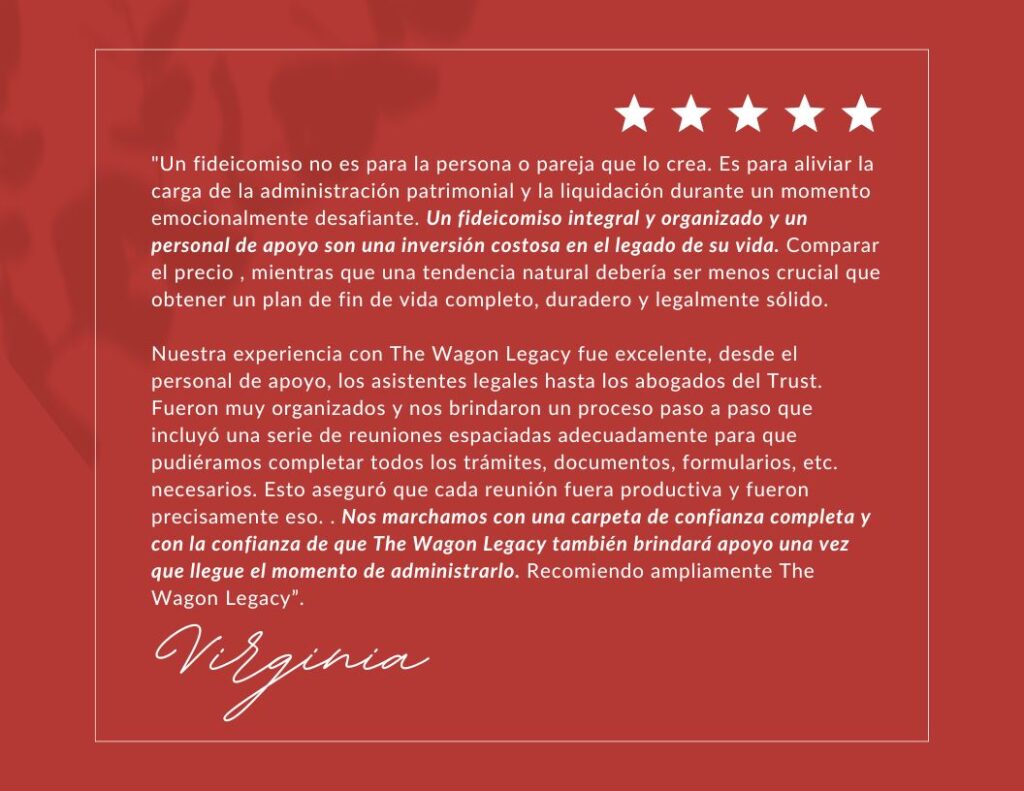

A recent client summed it up beautifully (thank you Virginia!) – here is what she shared on Google:

So yes – a trust with the Wagon will cost a lot more than $500 – but you will get what you need: protection, peace of mind, follow up, and a relationship.

If you are our client – thank you for entrusting me with your planning.

If you are not a client and need comprehensive estate planning help – please schedule a call here.

Lee esto en Español:

¿Es un fideicomiso de $500 la inversión adecuada para su futuro?

Recientemente una iglesia local me invitó a hablar sobre planificación patrimonial. La iglesia me preguntó si podía regresar y reunirme con algunos de los miembros de la iglesia para realizar consultas. Por supuesto, estaba feliz de hacerlo.

Me reuní con al menos 10 familias en la iglesia. Tres de esos clientes ya tenían confianza y querían que yo revisara su confianza. Los 3 fideicomisos tuvieron serios problemas. A un fideicomiso le faltaban párrafos de tal manera que el fideicomiso no tenía sentido. Otra dejó los bienes al exmarido de la mujer y ella no tenía idea. Y el tercero era el fideicomiso de un matrimonio que tenía solo 7 páginas.

Sin mencionar que una empresa o un servicio de redacción que ofrece planificación de bajo costo debe hacer muchos planes o ayudar a muchos clientes para que el negocio tenga sentido financiero, por lo que es muy probable que no le devuelvan la llamada cuando tenga una pregunta años después o es posible que sus hijos no reciban una llamada cuando usted quede incapacitado o fallezca y necesite orientación y ayuda.

Una breve historia: una clienta me llamó recientemente después del fallecimiento de su padre. Era dueño de 3 propiedades y tenía un fideicomiso Legal Zoom. La cliente me contó que mientras su padre agonizaba, literalmente 24 horas antes de fallecer, le pidió que llamara a un abogado. Le dijo a su hija que, si bien tenía un fideicomiso, sabía que no se había hecho correctamente. Me parece muy triste que justo antes de su fallecimiento, ¡esto es lo que le preocupaba!

Este es un gran contraste con lo que sienten nuestros clientes: nuestros clientes encuentran la tranquilidad de saber que sus familias están protegidas y sus deseos serán respetados. Esa es la diferencia con The Wagon Legacy: no solo creamos fideicomisos; construimos relaciones duraderas y brindamos seguridad genuina para el futuro.

Un cliente reciente lo resumió maravillosamente (¡gracias Virginia!). Esto es lo que compartió en Google:

Así que sí, un fideicomiso con Wagon costará mucho más de $500, pero obtendrás lo que necesitas: protección, tranquilidad, seguimiento y una relación.

Si es nuestro cliente, gracias por confiarme su planificación.

Si no es cliente y necesita ayuda integral con la planificación patrimonial, programe una llamada aquí.